TRANSPARENCY AND BUSINESS ETHICS PROGRAM

TRANSPARENCY AND BUSINESS ETHICS PROGRAM

Purpose

At PERMODA Ltda., we are aware that fair market practices promote business development and growth by fostering free and equitable competition. As a result, we recognize that ethics and transparency are fundamental pillars upon which the development and growth of our organization are built. These principles are essential in preventing and managing risks related to corrupt practices and international bribery.

As a result of the above, we have established a Business Ethics and Transparency Program that aligns with External Circular 100-000011, dated August 9, 2021, issued by the Superintendence of Corporations of Colombia. This program is in strict accordance with the provisions of Laws 1778 of 2016 and 2195 of 2022.

Scope

PERMODA’s Business Transparency and Ethics Program (BTEP) is structured and implemented based on several key criteria, including economic activity, geographic presence and stakeholder involvement. This approach enables us to systematically identify, quantify, control, and continually monitor any incidents or circumstances that could potentially impact the effective management of the risks of Corruption and Transnational Bribery (C/TB). These risks can arise from our interactions with suppliers, contractors, customers, as well as both domestic and foreign public officials across various national and international transactions.

Likewise, the regulations outlined in this document are obligatory for all individuals affiliated with our organization, including permanent and temporary staff, interns, suppliers, customers, contractors, and any other stakeholders who may have a connection to the program.

Definitions

⋅ Senior Management: These individuals are those designated, as per PERMODA’s bylaws, to oversee and lead the company. In this context, they would be the legal representatives of the company.

⋅ Associates/Partners: These are legal persons that have made a financial or non-monetary contribution, such as labor or other tangible assets with monetary value, to the company in exchange for ownership shares or quotas.

⋅ Business Partners: Any legal entity that maintains a business relationship within the PERMODA supply chain.

⋅ Compliance Audit: It refers to the systematic, critical, and regular evaluation process designed to ensure the effective implementation of the Transparency and Business Ethics Program.

⋅ Report Channel: Means the online reporting system that receives various types of reports, including those related to transnational bribery or corruption, among other matters.

⋅ Client: Any individual or legal entity with whom a commercial or contractual relationship exists, typically involving the supply of goods or services.

⋅ Conflict of Interest: When an individual within a company possesses professional, personal, or private interests that diverge from the interests that the individual is anticipated to uphold when representing the company, a conflict of interest arises. In essence, the individual’s interests are in conflict with those of the company.

⋅ Contractor: In the context of international business or transactions, a «contractor» pertains to any third party that offers services to PERMODA or maintains a legal contractual relationship of any kind with the company. Contractors may encompass various entities, including but not limited to, suppliers, intermediaries, agents, distributors, advisors, consultants, and individuals engaged in collaboration or joint venture agreements with the company.

⋅ Counterparty: Counterparties are any natural or legal person with whom the company has commercial, business, contractual, or legal connections of any nature. This category encompasses a wide range of entities, including shareholders, partners, employees of the company, as well as customers and suppliers of goods and services, among others.

⋅ Corruption: These are all actions or behaviors with the objective of securing benefits or advantages for a company or pursuing its interests, often used as a means to commit crimes against public administration or property, or engage in transnational bribery activities.

⋅ Due Diligence: A periodic review of the legal, accounting, and financial aspects associated with a business or transaction, conducted with the aim of identifying and assessing the risks of corruption and transnational bribery that could impact PERMODA.

⋅ Employee: This is an individual associated with PERMODA through an employment contract who possesses the following characteristics: He/she provides services directly to the company, he/she receives remuneration in the form of a salary through payroll and he/she adheres to a schedule established by the company.

⋅ Risk factors: These are the potential elements or factors that can give rise to risks associated with corruption or transnational bribery (C/TB).

⋅ Compliance Officer: This individual is appointed by the Board of Partners to head the Transparency and Business Ethics Program in accordance with regulatory requirements.

⋅ Compliance Policies: These are the overarching policies established by the company’s senior management to ensure that the organization conducts its business affairs in an ethical, transparent, and honest manner. These policies are designed to enable the company to identify, detect, prevent, and mitigate risks associated with transnational bribery and corruption.

⋅ Business Transparency and Ethics Program (BTEP): This refers to the comprehensive collection of policies, standards, and specific procedures overseen by the Compliance Officer. Its primary objective is to implement the Compliance program effectively, with the goal of identifying, detecting, preventing, managing, and mitigating corruption and transnational bribery risks, along with any other risks associated with acts of corruption that could impact the company.

⋅ National Public Official: Means any individual who is employed and works within the Colombian government, whether at the federal, state, or local level. This term includes members and candidates of political parties, as well as employees of government or government-controlled enterprises.

⋅ Foreign Public Official: An individual who holds a legislative, administrative, or judicial position in a country other than Colombia, including its political subdivisions or local authorities, or in any foreign jurisdiction. This definition applies whether the person was appointed or elected to the position. Additionally, a foreign public official encompasses anyone who carries out a public function for a foreign state, its political subdivisions, or local authorities, whether within a public body, a state-owned enterprise, or an entity whose decision-making authority is subject to the control of a foreign state, its political subdivisions, or local authorities. This definition also extends to officials or agents of public international organizations.

⋅ Transnational Bribery: An action by which a legal entity, utilizing its employees, administrators, associates, contractors, or subsidiary companies, directly or indirectly provides, offers, or promises to a foreign public servant: (i) Monetary amounts, (ii) Items with monetary value, or (iii) Any form of benefit or advantage, in return for that public servant undertaking, refraining from, or delaying any action pertaining to their duties related to an international business or transaction.

⋅ Third Party: These are individuals who, despite not having a commercial or contractual association with PERMODA, could be adversely affected by a violation of the Transparency and Business Ethics Program (BTEP) policies. They are eligible to utilize the transparency hotline to report any suspicious or unlawful activities.

Setting the Context

The Transparency and Business Ethics Program establishes a conduct model that is implemented within the company. This model is then extended to all its counterparties, fostering trust in PERMODA’s national and international operations. It serves as a hallmark of integrity and transparency, setting a standard for ethical and transparent practices.

The Transparency and Business Ethics Program (BTEP) is implemented to prevent the following crimes:

⋅ Transnational Bribery: Based on the definition and scope of this crime, it can potentially take place within the various processes associated with PERMODA’s supply chain and in any of the jurisdictions where the company conducts its commercial operations.

⋅ Corruption: The following provides a general overview of the characteristics of this crime, as well as other offenses categorized under corruption, which were considered in the development of the risk matrix.

Nature: Public or private

Source: Internal or external

Actor Role: Active or passive

Crimes considered in the system:

⋅ Bribery of National and International Public Officials

– Extortion

– Bribery

⋅ Bribery in the private sector

– Private corruption

⋅ Embezzlement, misappropriation or other forms of diversion of property for a public official

– Embezzlement by use

– Embezzlement by different official application

– Omission by the collector

⋅ Embezzlement, misappropriation or other forms of diversion of property

– Improper management practices

⋅ Influence peddling

– Influence peddling

– Private influence peddling

⋅ Abuse of office

Abuse of authority and other violations: Engaging in arbitrary or unfair actions, neglecting to condemn wrongdoing, revealing confidential information, utilizing privileged data, dispensing unlawful advice.

⋅ Special types of risk for the Company

Facilitation Payments: Small, informal, and improper payments made to a low-level official in order to secure or expedite the completion of a routine or essential task, to which the individual making the facilitation payment is rightfully entitled.

⋅ Special types of Expenditures:

– Gifts, hospitality, travel and entertainment

– Political contributions

– Donations or sponsorships

⋅ Conflict of Interest

It is important to note that crimes such as transnational bribery and money laundering are handled separately: the former within the framework of the Transparency Program, and the latter under the System of Self-Control and Comprehensive Risk Management for Money Laundering and the Financing of Terrorism (SAGRILAFT).

Commitment by Senior Management

PERMODA recognizes the vital role of combating corrupt practices that undermine transparency and promote unfair conduct within the country. In line with this commitment, the organization’s senior management places a high priority on tackling these issues and channels its efforts towards prevention. This is achieved through the establishment of guidelines and policies for the effective development and implementation of the Transparency and Business Ethics Program, in alignment with relevant regulations Our commitment is reflected by the following:

– The adoption of the Code of Ethics, which outlines the organization’s principles and values and sets forth additional standards of conduct expected from employees, encompasses guidelines regarding conflict of interest.

– The definition of the Transparency and Business Ethics Program aims to consolidate all the company’s guidelines for preventing corruption and transnational bribery.

– Providing the necessary resources to the Compliance Officer for the effective implementation of the program.

– Fostering a culture of transparency and integrity within the organization, where transnational bribery and corruption in general are deemed unacceptable.

– The management, prevention, detection, and rectification of situations that could lead to the risks of transnational bribery or corruption are carried out through the implementation of established ethical guidelines.

General Policy for Preventing Corruption and Transnational Bribery

PERMODA, under the guidance of its Board of Partners, Legal Representative, and team members, unequivocally rejects transnational bribery, corruption, and any actions that may constitute these offenses. Furthermore, it firmly and consistently expresses its commitment to implementing the requisite procedures, controls, mechanisms, and tools for effective management of the BTEP and the execution of the company’s defined policies and guidelines. This is aimed at identifying, detecting, preventing, managing, and mitigating the risks of corruption and transnational bribery (C/TB).

All employees of PERMODA are required to assume their defined roles and responsibilities, participate in or conduct scheduled training sessions, and adhere to the system’s policies. Non-compliance will result in the application of sanctions without exceptions, in accordance with the internal workplace regulations.

To effectively combat transnational bribery and corruption, every party involved in the company’s activities shall, within the boundaries of their respective policies, laws, and regulations, take necessary measures to ensure transparency in all operations conducted.

All provisions related to transnational bribery and other corrupt practices encompass behaviors such as acceptance and solicitation by employees or public officials. This also extends to senior managers in the public sector, where the use of power or the perception of influence peddling may be anticipated in exchange for favorable outcomes in processes conducted by the company.

This policy has no exclusions for compliance.

Values and Principles

The following principles are designed to steer the conduct of all counterparties when confronted with situations that could potentially lead to violations, which may not only amount to disciplinary offenses but could also culminate in acts of corruption or transnational bribery. These are:

– Principle of Good Faith: Act in good faith, with diligence and care, consistently upholding respect for individuals and legal compliance, while prioritizing the principles and values of PERMODA over personal interests in decision-making.

– Principle of Honesty: All PERMODA employees, as well as those who act on their behalf or have a direct relationship as counterparties of the company, must always adhere to truth and genuine justice, which includes being just with oneself. Likewise, they should act with coherence, aligning their actions with what is established and regulated within the company.

– Principle of Integrity: All third parties covered by this program are required to align their actions with the values and other principles that form an integral part of PERMODA’s organizational culture.

– Principle of Loyalty: Everyone is expected to promptly report any incidents or irregularities committed by any employee, contractor, or third party acting on behalf of the company that may impact or jeopardize the interests of PERMODA or its counterparties. If an employee prefers to maintain their identity confidential, they have the option to report anonymously through the transparency hotline.

– Principle of Legality: All individuals associated with PERMODA are obligated to adhere to the law, ensure compliance with the established policies and all relevant documents within the Transparency and Business Ethics Program, as well as the regulatory directives issued by authorities or regulatory entities concerning transnational bribery and corruption.

Values for the Prevention Corruption and Transnational Bribery

PERMODA, as outlined in its Code of Ethics, has defined values that serve as the foundation governing the attitudes, motivations, and actions of its employees. These values are an essential component of the Transparency and Business Ethics Program. Adhering to these values and the principles outlined above not only facilitates program compliance but also aligns with other company regulatory requirements and ensures the proper conduct of employees or contractors in any situation that might expose them to such circumstances.

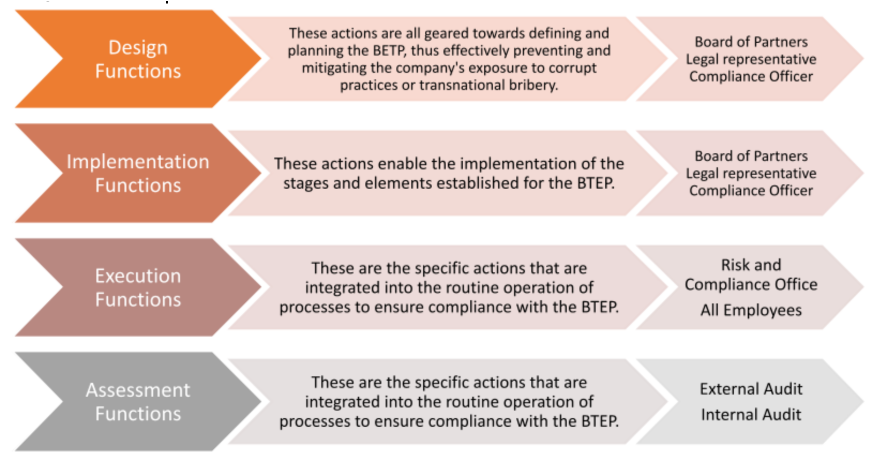

Roles and Responsibilities